Vat In Saudi Arabia Pdf

Engage an adviser to review your vat returns and streamline vat compliance.

Vat in saudi arabia pdf. In brief on 11 may 2020 the government of the kingdom of saudi arabia ksa announced several measures to counter the financial and economic impact of covid 19 on the government budget. Engage an adviser to conduct a health check. Vat in the kingdom of saudi arabia. With vat applying to almost all supplies of goods or services subject to limited exceptions.

Common pre implementation actions 8. M 51 dated 3 4 1438 h. Remember that under the terms of. On 11 may 2020 the government of the kingdom of saudi arabia ksa announced several measures to counter the financial and economic impact of covid 19 on the government budget.

Kingdom of saudi arabia. One such measure was an increase in the vat rate to 15 that would be applicable from 1 july 2020 onwards. Faqs on the recent vat rate increase may 2020 insights tax and legal services pwc middle east. For information the table below compares the vat treatment of supplies made in some sectors in the ksa with that indicated by the uae s vat vat law.

Vat is applied in more than 160 countries around the world as a reliable source of revenue for state budgets. Pursuant to the provisions of the unified vat agreement the. Value added tax or vat is an indirect tax imposed on all goods and services that are bought and sold by businesses with a few exceptions. The introduction of vat in saudi arabia.

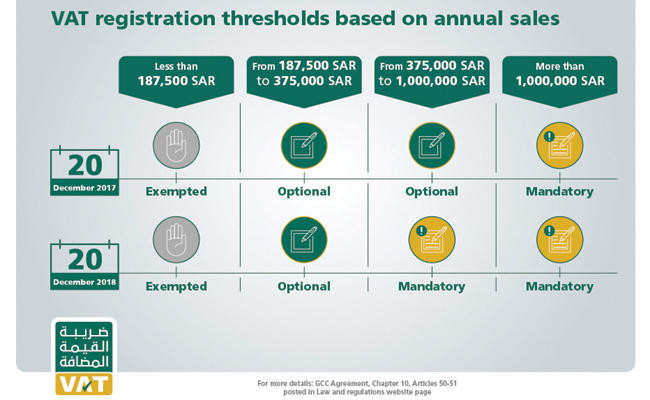

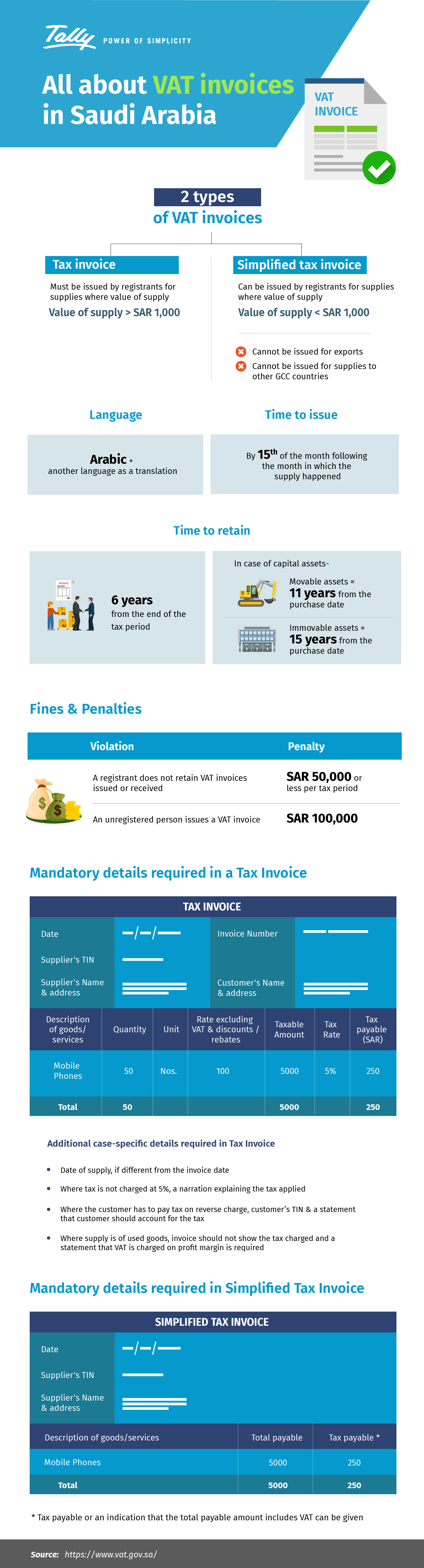

From 1 july 2020 saudi arabia s standard vat rate will be higher than in many mature vat jurisdictions such as australia canada china egypt and lebanon. A vat invoice is to be issued by registrants for all supplies of taxable goods or services. Implementing a value added tax vat system in the kingdom of saudi arabia ksa the unified vat agreement for the cooperation council for the unified arab states of the gulf the vat agreement was approved by the ksa by royal decree no. The kingdom of saudi arabia the ksa has introduced value added tax vat with effect from 1 january 2018 in accordance with the framework agreement among gulf cooperation council the gcc member states known as the unified vat agreement for the cooperation council for arab states of the gulf the agreement.

Saudi arabia is reducing various expenditures suspending the cost of living allowance and tripling vat as the kingdom looks to offset the impact of the coronavirus pandemic on its economy and.